Yesterday Simon Bridges delivered a fairly major speech, outlining the National Party’s intentions ahead of next year’s election. Of particular relevance was him reaffirming that, if elected, National would cancel the Auckland regional fuel tax:

If National is elected in 2020 we will:

☑️ Repeal the Auckland Regional Fuel Tax

☑️ Ensure no increase in petrol taxes during our first term

☑️ Have no new taxes in our first term

☑️ Repeal a Capital Gains Tax— Simon Bridges (@simonjbridges) January 30, 2019

One term governments are pretty rare in New Zealand, with the last one happening in the early 1970s, but it’s worth having a think about what would happen if an incoming government got rid of the Regional Fuel Tax.

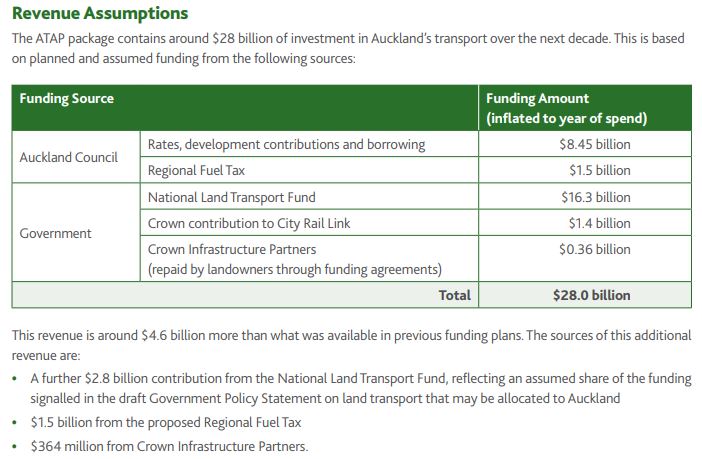

To do this, we need to first start with the difference the Regional Fuel Tax made in the funding information that sits behind the Auckland Transport Alignment Project (ATAP) and then the role the tax plays in supporting Auckland Transport’s Regional Land Transport Plan. By itself, the RFT raises around $150 million a year, or $1.5 billion over the 10 years:

However, the impact of the Regional Fuel Tax is actually quite a lot bigger than this. The way transport funding in New Zealand works is that NZTA co-fund high priority transport projects that a Council has money for. As a general rule of thumb, they will provide 50% of the costs but in some cases they may provide more. If the Council doesn’t have the money, then the NZTA money ends up going to another region or on project that don’t need Council funding (like motorways).

Similarly, the Regional Fuel Tax also makes it possible to do projects that also justify being funded through Development Contributions. Ultimately, this means the $1.5 billion of Regional Fuel Tax actually allows Auckland Transport’s investment programme to be nearly $4.3 billion, muchj bigger than it would otherwise be able to afford.

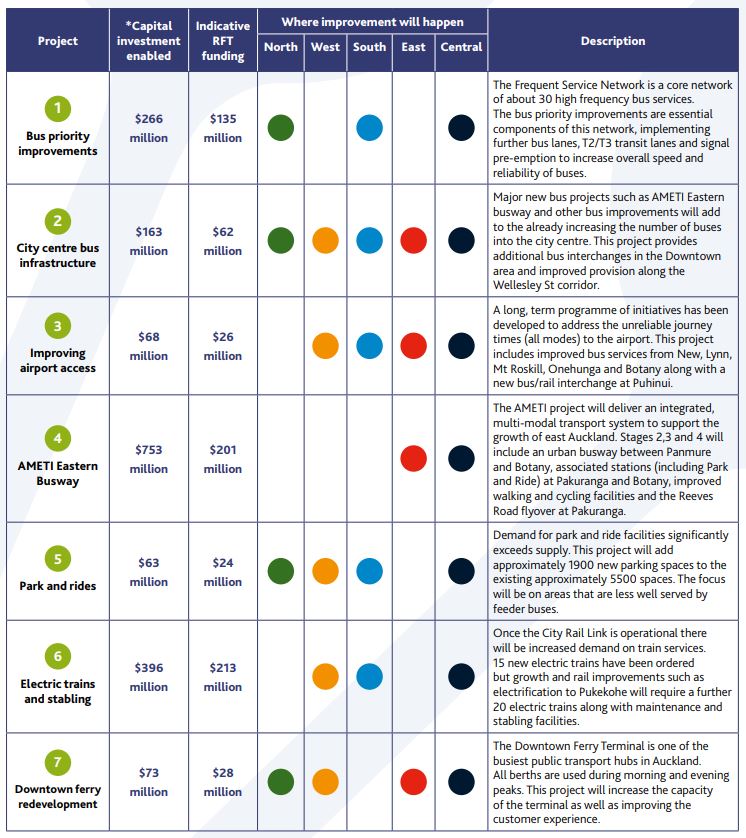

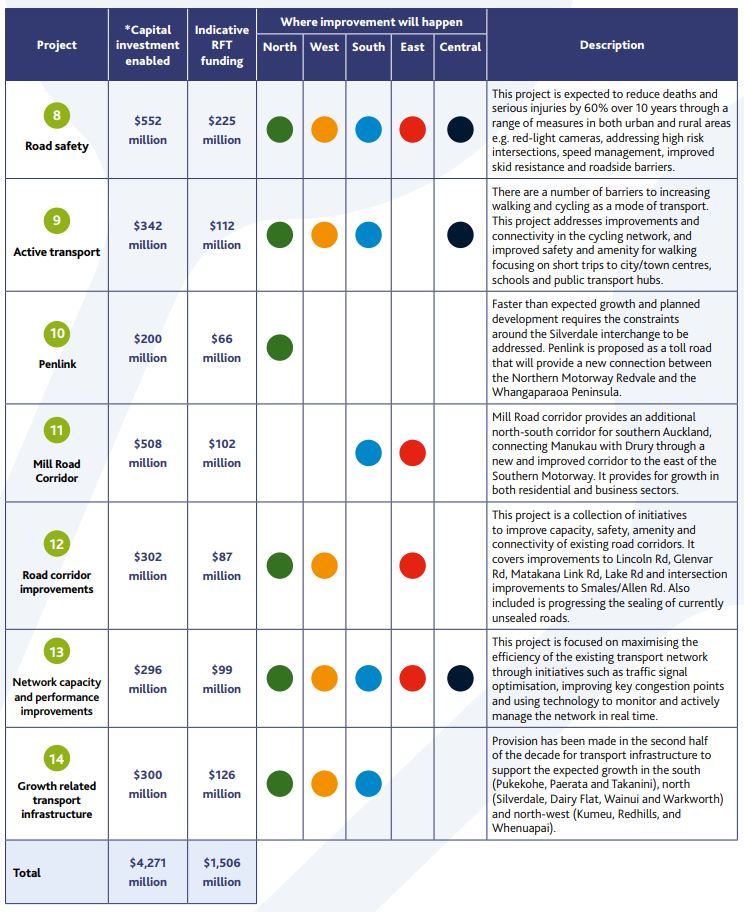

This is a lot of money and means that basically nearly all of Auckland Transport’s non-committed investment programme over the next decade is dependent on the Regional Fuel Tax.

All of these projects:

Now in reality, if the Regional Fuel Tax was cancelled would all these project just magically stop? I kind of doubt it, as a number would be under contract already and the political ramifications of cancelling essentially the entire transport investment programme in a fast growing city like Auckland are, shall we say, severe.

If an incoming government were to cancel the regional fuel tax one of three things might occur.

- The Council might be forced to replace this lost revenue through other means. As I discussed in the middle of last year, before the Regional Fuel Tax was confirmed, in some respects it would be fairer for the Council to raise the $150 million a year from rates than from a Regional Fuel Tax. Rates are a broadly progressive tax, with higher value properties paying more, whereas fuel taxes are somewhat regressive – especially in Auckland where outer areas (where lower income households are concentrated) are currently more dependent on private cars than inner areas.Based on the information last year, this would mean approximately an immediate 10% rates increase (plus GST), on top of the typical annual 2.5% increase that has occurred in the past few years. Such a large rates increase would usually be political suicide for the Council and National might relish the opportunity to ‘stick it’ to Phil Goff, if he is re-elected, but in this case the council could quite clearly put the blame on the incoming government and say that they’ve been forced into the rates increase .

- The government might look to cover the lost funding themselves. In its most simplest form, they could just cover the $150 million annually from general taxes. This would be relatively easy to do and would ensure the current funding from the NZTA remains unaffected. The downside to this is the optics from the rest of the country which might be perceived as just ploughing more money into Auckland at the expense of the regions.

- They may choose to renegotiate which projects get built under another revision of the Auckland Transport Alignment Project. This could see projects cancelled or reduced in scope in order to fit within a new funding envelope. However, depending on the timing of projects this may be easier said than done. For example it may be difficult to cancel the current governments flagship Light Rail project if contracts have already been signed and works have started. This would also go against the previous National government’s agreement back in 2017 that it was necessary to spend $1.2 billion on Dominion Road rapid transit over the next decade. The government would also need to explain to local communities why they’re cancelling these projects, especially if they campaign on the premise of building more stuff.

None of these options sound all that great and the final outcome could include parts of all three. Given that petrol prices have now dipped well below their highs in the middle of last year and most Aucklanders are probably now used to the new costs, it seems like getting rid of the Regional Fuel Tax would just create a massive political headache for any new incoming government. Therefore it is surprising that Simon Bridges continues to champion this.

Processing...

Processing...

I’d prefer the Government revisit the idea of Auckland being expected to cover a ‘user pays’ levy to fund development transport options and then it being immediately ruled out for other cities, despite places like Wellington having their own Light Rail ambitions.

As for the rest of the country and “optics”: For decades money flowed out of Auckland and into other areas so they could have nice things. It’s kind of why we’re in this mess. Funny how “We’re all in it together” when the provinces need something, but we’re a bunch of Dorklanders when we dare try to get some critically needed deferred infrastructure built.

“…Therefore it is surprising that Simon Bridges continues to champion this..”

National is still convinced it won the last election, so it continues to campaign on the same policies it ran on in 2008 when it won power. Also, it seems to find the temptation of trying to turn everything into a politically expedient culture war impossible to resist.

It’s very odd for something like this to be announced so early in a term. It looks more like an internal campaign for the leadership of the National party than an election announcement. The inflation adjustment is something the right of the party have campaigned on for years, he is just trying to fight off Judith Collins at the moment.

The timing is perfectly set to upstage Robertson prior to releasing the findings of the tax working group.

While it is very regressive, until GPS road pricing is introduced I’d prefer to see the tax increased as it should both raise money and reduce the number of cars on the road.

If an 11.5c tax gathers $150 million p.a., then a $1 tax should gather $1 billion p.a. and see a serious reduction in cars. It could fund the councils share of CRL sized projects every 2 years and be transformational.

Surprising that there have only ever been two 1 term governments, 1957 & 1972, the 2nd & 3rd Labour governments.

…of course if it sees a serious reduction in cars it won’t bring in $1b pa for long.

Had to read up on the 2nd Labour government. Brought in television, Manapouri and Tiwai Point, and polytechs, but were undone by the 1958 black budget.

The policy is driven by political expediency and an underlying philosophy that public transport projects are wasteful and unnecessary and everyone should be driving their own car everywhere all the time. Don’t ask them how this ties up with their position on climate change because it seems they think you grandstand at international conferences and then do exactly the opposite at home and no one will notice.

Lets suppose hypothetically that National wins next year and from say July 1 2021 the regional fuel tax is repealed. by that time it will already have been in place for three years and around $500m would have already been raised from it. Obviously this still leaves a $1bn shortfall but much less than $1.5bn. Could the council sell assets if need be to cover this shortfall? Also I’m not certain if a 10% rates increase is political suicide, other councils around the country have done it, and incumbent councilors have a very high re-election rate

Council selling assets to balance the books year by year is like NZ ruining its environment and selling land to balance its economy year by year. If raising rates isn’t political suicide – and I’d like to think it’s not, we should have raised them ages ago, and prevented the loss of biodiversity and stream and harbour health.

Funny how selling assets is ok when the left are doing it.

I haven’t forgotten the 17 state assets Labour sold.

“Funny how selling assets is ok when the left are doing it”

Evidence that this is a widely held belief on this site.

“I haven’t forgotten the 17 state assets Labour sold”

Which assets by which Labour government? Not all Labour governments were the same and not all Labour governments were left wing.

There is also option 4: cut council spending in other areas or a mixture of all 4.

Would you rather they sold off parks or closed down libraries?

Given transport makes up such a large chunk of council spending there would have to be some pretty severe cuts in other areas to balance the books.

It would actually work quite well; with rubbish piling up on the streets, broken playgrounds and horrible parks, no concerts or events, polluted beeches, no tourism, a horrible car dominated CBD, etc, there would be a lot of people leaving and no need for new transport or infrastructure. Win/win?

Maybe this should be Palino’s new campaign this year – ‘I’ll get rid of all the other people’.

I didn’t say I was in favour but it is an option. However, let’s be very honest, the council is not the most efficient organisaiton in the world and I am sure cuts can be made.

Like all councils and governments there is plenty of fat in the system. However, no politician that I’m aware of has ever succeeded in getting rid of this fat without causing significant problems. It’s not even an option that is worth wasting any time on.

Actually, councils should “waste their time on” before they come and ask for more money. Until they have done that then we can’t say it would be a waste of time.

And like most large private companies employing that many people there is plenty of fat in the system. Try working at a major corporation and tally up all the wasted money. Even medium sized corporates can be incredibly inefficient.

Easy to look at an efficiently run SME in NZ and then ask why a major corporation or government body isn’t run that efficiently.

Obviously there’s plenty of room for improvement, but when you think of everything that Council does – can you name me a single private company that you’d receive similar value from for your rates?

I agree that things can always be improved, including council systems and processes, however how do you measure Council efficiency in an objective manner? As without some form of objectivity the whole argument becomes a political football!

The council and government that offer us better sustainable transport (and resulted cost savings in this regard) with be the ones who receive my vote as opposed to any council and government who proposes to save us money by lowering taxes or rates.

Good point about a single term Government. And the damage they can wreak.

The last time we had one of those, it was a Labour Government, that lasted from 1972 to 1975.

[the fact that the Prime Minister (Norman Kirk) didn’t see out the full 3 year term probably ensured it would be that way].

And in that 3 years they implemented/encouraged a lot of far reaching changes to Aucklands transport plans (Robbies Rail) and also wider NZ society – including widening the ACC Act to cover more NZers than the original required as well as overseas visitors prior to its introduction in 1974. They also introduced the first version of a portable version Superannuation – effectively Kiwisaver version 1.0. As well as stood up to the French atmospheric nuclear testing both at Mururoa Atoll and also at the World Court in The Hague. Which eventually drove them to do underground testing rather than in the open air.

As soon as National [Muldoon et al] got into power they kicked they basically cancelled Robbies Rail and killed the Labour Superannuation dead. They dicked about with all sorts of other transport regulations, letting the trucking industry begin to run the countries transport policies, running down rail. All in the guise of standing up to the unions and the alleged “Red Menance”.

[really Muldoon wrote the text book on the plays that Trump is now following].

And many of those “short sighted” knee jerk reactions by National have led to real repercussions we’re still living with even now. Cancelling Robbies rail was one thing, getting rid of the corridors for evermore – unforgiveable. But thats how it was done – seemingly the policy was “not only will we deny your plans, we will salt the fields as well to ensure you cannot ever have them, ever again!” – How self-serving and short sighted.

Ever wonder why the Governments ever since encouraged/championend all these separate [bickering] Auckland Councils for so long? To prevent Aucklands collective tail wagging the Wellington Dog.

And so similarly it seems, when/if Bridges-led National Government gets in they will no doubt wreak havoc on the Fuel tax and other Auckland transport projects sending us back into the “wilderness” for another 40 years of lost opportunity. All the while assuming that the free market will deliver.

The best way to avoid that is to push ahead faster and ensure the projects and plans we have are so advanced or, even better, finished and delivering the benefits, so that all can see the results. So that they only option is to carry on.and not try and pull out.

After all if we had even just the corridors from Robbie’s rail we’d not need some of the stupidly expensive stuff we are doing now. And we’d be light years ahead of now. Transport and lot of other things-wise.

I take it when you say we will be in the wilderness for the next 40 years if Bridges gets in that you are expecting the Labour governments that follow over this period to do bugger all as well?

The Kirk government never funded Robbie’s Rapid Rail, they just said they supported it, Muldoon was just more open in his dismissal of it.

What Auckland rail corridors did National sell under Muldoon? There’s still a few left unbuilt.

Jezza – National operates on short term planning hence the problems that NZ is experiencing today. At least the COL government is trying to do some long term planning.

Good post, Matt, and I’d say the mayoral hopefuls should have a read of it. So if $1.5 billion ends up as $4.3 billion over ten years, once the govt’s contribution is added in, on a yearly basis that’s $150 million in RFT ends up as $430 million for Auckland.

Does that mean a levy on parking in the city centre alone – at Sydney’s rates – with the revenue it would bring ($137 million/year) would end up around $400 million/year too? Of course it would drop reasonably quickly, as landowners quickly move to put the land to better uses. And that’d be a win too.

I’m not sure why this hasn’t been done yet. The AT board seemed to discuss parking prices when they decided to put up PT fares instead. But I didn’t see any mention of parking levies. Anyone know what’s holding that discussion up?

GA – very much off topic but any thoughts on these trams?

http://theconversation.com/why-trackless-trams-are-ready-to-replace-light-rail-103690

Are buses, largish buses, but very low capacity compared to modern Light Rail Vehicles, more like old trams, probably an option for medium demand routes, and shape may have more appeal than usual buses? Electric is good.

Insufficient capacity for the two LR routes in AKL, could be a fit for Airport to Botany? Depends on timing of that whole route and likely ridership…?

Thanks Patrick.

If you have the corridor for them to run on and they can carry upto 500 people at a time surely it’s just a frequency thing to satisfy demand?

That fact that you don’t have to dig up streets and lay rail lines is surely a massive plus on the cost and disruption front?

You’d definitely have to dig up streets if they were going to be run at that level of frequency following the same track all of the time. The roadbed would need significant strengthening, the cost of actually laying rails is relatively minor.

I’m not a civil engineer, but I do wonder if they put a stupidly thick layer of reinforced concrete on top of the road bad, where is it going to go? Wouldn’t the force end up distributed over a large area? Bolt some rails on top and its good to go…

I wonder if this option was ruled out years ago as being too expensive – but with today’s Labour costs it would have to work out significantly cheaper.

Wouldn’t that just play havoc with levels in the streetscape?

Jimbo: Putting a relatively rigid layer (concrete) on top of a flexible layer (compacted aggregate pavement) means the rigid layer breaks up like a jigsaw puzzle. This not only means the road fails, but it gives horrible ride quality while it’s failing. It also means getting to any buried services (3 waters, power, telecom, gas etc) is really difficult and expensive.

Jezza is right, you need to rebuild the road from the bottom up with heavier vehicles in mind.

A major part of the issue is that before you pour a track slab or concrete road bed, you need to move all the services out of the way first. Otherwise you risk not being able to access or repair your services every again (or have to shut down a transit line for six weeks and remove a huge section of reinforced concrete just fix a leaky pipe).

$130m aud per km in Sydney is hardly minor.

$130m/km isn’t the cost of laying track any more than laying track in the CRL is $1b a kilometre. Laying track might be $1.3m/km.

Nick’s point is correct. The cost is in the right of way much more so than just laying track. To get the order of magnitude cost claim they cant be digging and forming a separate right of way, just painting a lane, and indeed that’s what the images show.

Also there’s no overhead, so the power cost is not in the route but in the vehicles and depots, super capacitors or batteries and charging infrastructure. So Newman’s figures are more than a little sneaky unreal here.

Jezza – With LR the track still have to be renewed especially on corners, points and crossovers which have high wear every 20-30 years. Also when laying track, there needs to be a concrete foundation for the tracks to on it which is similar to building a BRT/ART network route. It is more economical to maintain a BRT/ART road than a LT route.

Kris – I agree with you that LR tracks need replacing just as tarmac and tyres do on BRT, and also that LR needs to be strengthened underneath.

However, the big difference is LR does not require an expensive guidance system to follow the same track all the time, steel tracks are positively cheap compared with these systems.

Also as others have mentioned steel has less friction, reducing running costs and also LR has a higher capacity than these proposed vehicles.

500 pax? link please.

The link is in the post above.

“In three years of trials no impact on road surfaces has been found. ”

How do you know that an opinion piece is rubbish? Statements like these two:

“In three years of trials no impact on road surfaces has been found. ”

“$6-$8 million per kilometer”

Imagine a world in which, for AU$70m you can build a concrete pad of 70,000 square metres and overlay it with asphalt; relocate the kerb lines on the rest of the route; buy necessary land; install lighting, power supply, ticketing machines, shelters, tactile paving, traffic lights, signage, road marking, wayfinding, and route information; buy and commission vehicles; and buy land.

You’ll have to imagine, because that world isn’t real.

Just like Musk’s boring company, this fluffer is counting 10% of the costs and then claiming a saving. Assuming an optimistic average speed of 30km/h including stops, to get a service every five minutes you need 1.2 buses for every kilometer. Even for a standard double decker, the buses alone are NZ$1m/kilometer.

Well it’s 300, 500 will be Asian crush loading which is not used here, as is typically +50% on what people outside of mega cities will accept: zero personal space.

Patrick R – With regard to your comment – “Well it’s 300, 500 will be Asian crush loading which is not used here, as is typically +50% on what people outside of mega cities will accept: zero personal space’. How do you know, have you ridden on a trackless tram?

I have the technical specification document for this from the manufacturer. They calculated the figure of 300 passengers in a 24m long vehicle based on a standing rate of eight people per square metre.

In New Zealand, four people per square metre is considered an unacceptable crush load.

If you factor the capacity at four per square metre, the same as is used for the light rail estimates, the capacity is only about 120 people per vehicle.

Trackless trams accurately follow the same path each journey, compared to other tyred vehicles that wander a little and therefore spread the load more evenly across the lane. A considerably concentrated path imposes greater dynamic loads and concentrates the wear. The larger dynamic loads require considerably stronger pavement, either a far greater depth of ashphalt and basecourse or more likely a reinforced concrete bed. A concrete bed even stronger then that required for trams running on steel rails because of the lack of the load spreading inherent by the rails.

Surface wear requires periodic surface removal and renewal. Steel rails are much more wear resistant then any asphalt topping.

These same steel rails provide two further very considerable advantages. They provide a very simple, low maintenance, and very robust guidance system. Secondly steel rails provide one of the two electrical paths required to form a simple power supply to power these vehicles.

It is these proven advantages of steel tracks that have limited the adoption of trackless tram systems elsewhere.

I am afraid I see that offering trackless trams is just another diversionary tactic by business vested interests, like self driving cars and flying ubers, to try to delay any alternative to SOV total pre-eminence.

+1

The concentrated load problem occurs with standard (non guided) buses in a narrow lane. That’s why the carriageway in ex Manners Mall (Wellington) has a thick concrete slab with heavy reinforcing steel under the asphalt.

There is still rail wear on corners, points and track crossovers that needs to replaced.

Muz – I agree with you but the LR fan club will come up with all the reason not to used them.

Kris! At least provide evidence. There’s plenty given above to answer MUZ’s question more fully than your ‘agreeing’ with him. I’d love to hear a well-researched opposing point of view, but you haven’t offered one.

Why can’t you come up with the evidence that LR is better than a trackless tram operation factoring that ongoing high cost of LR track renewal every 20-30 years especially on corners, points, track crossovers, etc.

“LR fan club”

Choosing that term and making that accusation without evidence reveals your own extreme mode bias …

How do you know I am ‘extreme’ mode bias when I support LR, HR. BRT operations and a regular user of public transport.

I actually don’t care what technology is employed. Adequate system capacity, good transit speed, including dwell time at stops, and comfort, and reliability are my criteria as a passenger. The Paris metro system includes light rail, heavy rail, and tyred vehicles but above floor level the vehicles are basically indistinguishable. Getting the engineering right though at the start though will have cost and serviceability implications for the entire life of the system, and they are very long lived systems. I suspect though for those unwilling to concede road corridor space to rapid public transport systems then getting rid of the rails removes an impediment to reclaiming the roadspace for their beloved cars. Those who select the system have to be careful not to go down a blind alley. I understand that Adelaide has had trouble sourcing further buses for its guided busway systems. The number of existing standard gauge light rail systems in the world should ensure that off the shelf vehicles, equipment and expertise remains in good supply at competitive prices.

So last year immediately following the introduction of the regional fuel tax we got a sudden spike in fuel prices caused by rising oil prices and a drop in our dollar versus the US currency. So incredibly bad timing. But the coalition dodged a bullet because the adverse conditions reversed itself however the people were not amused and the govt is on notice to not do it again and I wouldn’t be surprised if the two scheduled fuel tax increases for this year and next are cancelled. To illustrate the extent of what the fuel rises cost the country consider this the value of imported petroleum products for the December 2018 year was $7.7 billion, up $2.4 billion or 44 percent compared with the prior 12 months. No wonder people were squealing as that figure doesn’t include tax rises. So I will not venture an opinion on how the money needed for projects should be raised but I will point out the huge savings for New Zealand if we could rapidly electrify our transport fleet and generally cut our use of imported fossil fuels by moving to active modes and public transport.

http://www.scoop.co.nz/stories/BU1901/S00441/fuel-imports-drive-nzs-annual-trade-deficit-to-11-year-high.htm

Two other slightly related things. Apparently one cow produces similar amounts of greenhouse gases as one large car. However the cow actually earns New Zealand some money the car however just costs us.

The other point is if you want the perfect transport project you increase its complexity. When you increase its complexity you push out the time it will take to implement.The politicians know this and love it because it also pushes out when you have to fund the project. So a promise of a light rail line taking 10 years to build is virtually worthless. But a promise of stage one of a light rail line to be built in 2 years is meaningful.So Greater Auckland do not accept or propose anymore mega projects the politicians are pulling your tit.

I think the next two fuel tax rises will still happen. Bridges in his speech yesterday made no mention of reversing the nationwide fuel tax increases, so it can be assumed that National have budgeted on needing this money. If National try and criticise the government for increasing the fuel tax Robertson can just turn and ask them whether they plan to cancel it, silence will follow.

I did say I wouldn’t be surprised but then again Simon can’t get back in power till the next election so maybe he has factored to allow for the resumption of the RONS So the coalition with a need for some brownie points leading up to the election and a less ambitious roading plan could disrupt National plans by scrapping the tax increases and it would be a popular move.

Sorry the comment about the cow versus the car came from a stuff article but I can’t find it. If you do find it don’t bother to read the comments you won’t find any sense there. The observation about politicians is my own base on my life experience.

Cow and car both need to be looked at; neither is managed well at the moment. They can both be part of a healthy economy and way of life if they were cut back in number and how they are managed is improved. So cows need to be part of integrated mixed farms, where they are fed from within the system, and their effluent is managed as a resource and doesn’t enter the waterways. And cars need to be managed, with emissions standards, better road layouts, and lower speed limits, so they don’t continue to cause multiple public, environmental and social health problems.

+100

The point of the article was that we needed to stop burning fossil fuels not just manage them down. I tend to agree remember we only have 10 years to stop irreversible climate change however we need the cows not just for food but to give us fertile soils. We have talked about this before Heidi. I am not pro big cow you are right about mixed farming. Electric everything mowers tractors line trimmers, trucks diggers cars and trains and expand renewable power to power them.

But we need Cows for food as much as we need Oil for electricity…not saying how people should live their lives, but it is a simple black and white fact, we don’t need to eat beef or drink milk.

I agree we need to stop burning fossil fuels, and work to reduce carbon emissions, not just net carbon emissions. The UN saying that biodiversity loss is as large a threat as climate change means we need to act on both our poor agricultural practices, and our poor transport practices. The exploitative mindset that has morphed farming into the state of our dairy industry is the same exploitative mindset that is reaping destruction throughout the natural and social world. I’m not arguing against you, Royce, I know you know this. I just think there is urgency around land use as well, given the damage being done to soils, to waterways, to coastal environments.

Hi Royce, I wrote the article, and I am very glad to see that someone read it and took my point (unlike most of the commenters)! In my experience readers have to have a point of view fairly close to the author’s in order to absorb new information from a short article, otherwise they can either miss the point or, worse, take away a completely different point. So my idea to combat this was to simply repeat the phrase “stop burning fossil fuels” in the hope that it would sink in…

“The coalition dodged a bullet because the adverse conditions reversed itself however the people were not amused and the govt is on notice to not do it again”

Funny how a National government are all for privatisation, but when it comes to transport they don’t even want full user pays let alone privatisation. If they cancel the fuel tax rises and the Auckland fuel tax it will just mean transport will be more subsidised by general tax and general rates.

At the very least a true right wing party would want transport infrastructure to pay for itself and make a return on investment, but privatisation should be the real option (supposedly it would be more efficient and cheaper!). The government doesn’t give food or power away at less than cost price, why transport?

This is not about left or right its about winning elections. You can’t do diddly squat while your in opposition.

But surely subsidised transport should have the same “middle class welfare” tag applied as other policies such as free tertiary education.

Logic and consistency doesn’t win elections. People can take opposing positions for example being anti congestion and anti taxes to pay to improve the congestion at the same time. Its up to the parties which are vying for political control to find an acceptable middle ground. I can only go back to the numbers I gave in my original comment.I think the answer lies in the $7.7 billion we spend on importing oil. This money is a total loss to New Zealand.

Indigenous renewable energy powered private and public transport plus improved cycling and walking infer structure will increase our nations wealth and well being. How this increased wealth ends up in the transport pot I don’t know perhaps from general taxation or perhaps we won’t need so much transport. Meanwhile we need to keep the public on side.

“So Greater Auckland do not accept or propose anymore mega projects the politicians are pulling your tit.”

There’s certainly enough easily implemented gains to be had right now that don’t have to be mega projects. The change in focus from traffic flow to citizen experience is not an expensive one. It involves a whole lot of little changes.

There are heaps of little projects which could be implemented and which wouldn’t stir up violent political debate.Which is the other downside of the Mega projects. For example my plan to build half the third and fourth mains instead of rebuilding Middlemore station which would be a major if not damm near impossible and would cause major disruption. Incremental change not generational change. For Pete’s sake we have being waiting for the CRL for 15 years. And it will probably be 25 years by the time it gets finished.

I don’t see why rebuilding Middlemore station is damn near impossible, it’s certainly the biggest part of the third main but it’s minor compared with many infrastructure projects.

The third main with only two tracks at a station where a train stops every five minutes in each direction would significantly reduce the benefits of the third main. It’s time to get on and do the job properly on this relatively low cost high benefit project.

Neither do I see major difficulty in pushing the 3rd main through Middlemore. Trench it down western side of west platform and extend the current overbridge towards the car park building. Platform for 3rd not necessary. The only negative is that row of mature trees behind northern part of platform would probably need to be removed and the southern end of west platform gets shortened to let 3rd through. To continue to accomodate 6 car trains the west platform could be extended northwards.

Why is work for 3rd not progressing since I read here its already funded?

I think there will be platforms on the additional 3rd track. This would allow it to be used most efficiently and reduce cross-overs, for example a Port to Wiri freight train would use the eastern most track, but a Tauranga to Metroport train would use the western most track. I believe the third main will be electrified for exactly this reason, to ensure suburban trains can use any of the tracks, depending on need.

It hasn’t been specifically funded yet although there is broad budget funding for it. NZTA have requested a business case in their preferred format and Kiwirail are submitting that this year.

It is a third main. Not a freight track, but a third main line. Presumably that means it is electrified, bidi signalled and platformed like the other mains.

Would the W2W 3rd main have platforms at all the stations it passes through? I can see that the existing OLE traction masts have been placed to permit the 3rd main to be electrified but station platforms would be some major works at Papatoetoe and Puhinui. The planned upgrades for Puhinui don’t appear to include a western plarform for the 3rd main.

So why would Middlemore have a 3rd platform?

Isn’t the 3rd main initial use as a freight line withpossible use for limited stop expresses and RRR trains?

The purpose of the 3rd main is to add capacity, the initial benefactor would be AT who could then increase off-peak frequencies. If all tracks are electrified and have platforms and bi-directional signals it allows the signallers to determine the best use of each track at a given time.

The problem with having a western track being freight and RRR only is that a train from Ports of Auckland to the Wiri inland port for example would have to cross the north-bound commuter track at Westfield and then cross it again to get to the inland port at Wiri. A long freight train crossing commuter tracks would inevitably result in delays.

The Puhinui station design allows for four tracks, all with platforms. Not sure about the rest.

The third and/or fourth mains should allow full flexibility to route metro and other trains as best suits, for example they could increase capacity for all trains by unpicking eastern line trains in and out of Manukau, for example.

So lets just break this down into parts. For example there could be “third main from Puhinui to Middlemore heading north. Then we could have “Passing Track from Middlmore to Papatoetoe station heading South” and when that’s done we could have “Third main through Middlemore station. So instead of just lumping the whole lot together with a completion date of 2030.We could have each part handed for operation as it is completed.

…or just have the whole thing built in 2023. It’s a <$100m project, it doesn't need to be broken into parts. The only reason it hasn't already happened is the cumbersome process for getting funding for rail projects in NZ, this would be just as applicable if it were broken into parts.

Did you make up 2023 as far as I know its an open ended project. They will push it out as far as they can so they don’t have to fund it till they really have too. So if we are waiting on slots so we can expand Regional Rail we are waiting a long long time.

Yes, it’s my figure, it’s based on when I think it could realistically be done if NZTA approved funding once the business case is submitted this year. I can’t see any reason they wont approve it, they approved the much lower BCR Hamilton rail proposal.

I can’t see why you think the third main won’t get funding.

I didn’t say it wouldn’t get funded its when it gets funded that is the issue. If it takes 2 years just to do the design then it can’t be built until its 2 years.

A smaller project which only takes 6 months to design can start after 6 month.

Actually there is one way it doesn’t get funded or built which would be if it hadn’t being funded by next election or even if it has being funded then an incoming National Government could just scrap it either way or defer it again. So get a move on who ever is in charge start moving some dirt.

Agree, and instead of getting bogged down in distant mega projects we should look at more immediate and useful PT gains.

Need I say a good example is using existing rail resources with relatively minimum capex and opex to extend metro services to NW beyond Swanson. This would fit in nicely with the CRL bringing the Kumeu/huapai train journey times to what we have nowwith Swanson to Britomart times.

“The car just costs us” Yea all the time it frees up and the mobility it enables is just deadweight loss, I guess?

Has it done that on average, at the level of a society?

I believe there’s been good research shown here that all it has done is increased distances and that the great commuter has ended up spending just as much time travelling, but in a car instead of walking, cycling or using PT. Those not driving have had their distances and therefore travel times increased, by quite a margin.

So in terms of mobility, sure you can go further with a car. But you can do less by foot or bike, because everywhere you go, you meet barriers to mobility.

The difficulty of quitting motor vehicles is the motor trade gives so much from the very beginning of a vehicles concept until the day it is crushed at a recycling plant. Hence it is a very hard habit to break

In my experience they are a liability. They devalue the minute you drive them away from the sale yard they require endless maintainence and a endless supply of money to fuel them up and then there’s registration WOF’s insurance it just never stops. Best avoided if you can.

But then I have got one but I only use it sparingly.

havent had one for eight years, dont miss it either. My holidays arent spent in a car travelling to napier or taupo but on a jetplane to fiji bali or queensland. Walk to supermarket, plus the odd uber/lime, bike and bus/train for other things. Also 17kgs lighter than when I had one.

My challenge, then, is to inspire you to more local holidays… 🙂 I’m putting together a dossier at the moment with ideas, together with another GA reader. Not sure where or how we’ll launch it. But you don’t need to go to Fiji, Bali or Queensland. This is a pretty fine country to have holidays in.

I have 2. They’re fucking awesome and unrivalled.

Buying them on hire purchase is another significant cost.

Luke, you’re lucky. Remember that only one third of Aucklanders have access to frequent public transport – the rest of us need at least one car.

Our most urgent need is to increase that one third to as close to 100% as possible, then we will all enjoy reduced carbon emissions, a reduced car-related cost burden on households and indeed the health benefits that you have mentioned. To me this accessibility number is the most important KPI to measure Auckland Transport’s performance by.

Yes. It’s nice if you can get around mostly without a car.

Problem #1: it is not in many places where you can ditch your car and still participate in the city in a meaningful way. The ones where you can tend to be prohibitively expensive. I would no longer live in ‘Auckland’, but in ‘Birkdale village’. A short trip to Northcote turns into a 1 hour+ excursion each way.

Problem #2: you will not be making local holidays. Luke is right about that jetplane. For travelling in NZ, the lack of frequency on buses and the need to book in advance are debilitating. You’re a sitting duck if it happens to rain where your bus is going.

” Remember that only one third of Aucklanders have access to frequent public transport ”

That’s only true if you expect that everyone has to access it by foot or car. If people were able to access by bicycle, almost everyone in Auckland lives within 3 kms of a rapid transit station.

That is only 10mins by bike. How is that not access? So the answer (as always) is to improve cycling conditions with separated infrastructure on arterials and lower speeds on non-arterials.

It just so happens I don’t live within 3 km of a rapid transit station , just like everyone else west of Glenfield Road. (for me Smales Farm is about 7 km away.) Bring on that Onewa Road / Glenfield Road corridor plan.

I think the same is true for almost all of south-east Auckland.

But having a more civilized environment for cycling would indeed be a massive improvement for anyone who doesn’t drive (or is not overly keen on driving).

Come on Royce, clearly you aren’t the owner of a good V8, smooth, torque to die for that tips the body right when revved at idle and a sound that God created.

Try one, you’ll never look back except in regret that you didn’t get one sooner!

I purchased a Toyota Aurion V6 when I retired because I thought I was going to travel around with my caravan. Its quick but I found that towing halved the fuel consumption which wasn’t good to start with so I gave that idea up. My son now tows the caravan about 10 miles to the local beach campsite for his summer holiday. I have kept the Toyota because its comfortable when I travel down to see him and the grandchildren. But its a bit of a nuisance to park in tight car park’s so not much of a town car. Still that’s why they gave me the super gold hop card for.

I suspect towing vehicles may be the last of our fleet which will be electrified but who knows if you have a big enough battery anything is possible. Towing is part of New Zealand culture though.

Shut up in a metal box breathing in fumes and listening to Hosking? No thanks, I will stick with the clean fresh air and convenience of my electric bike.

I will pass you sitting in traffic in your V8 everyday! 🙂

Similar experience. Having not had one for five years due to them being irrelevant to our lifestyle, got one a year ago when we relocated back to central Auckland. Has some convenience merits like going to get a gas bottle refilled and journeys around the rest of the island. Financially not wise. Cost a bucket when rats discovered a rarely used home and added vital wiring to their nest. Fuel light now on Orange, after last fuelling in August!!. City Hop and rentals would have been a lot cheaper. Love Winston’s Gold Card.

CityHop is awesome!

Follow the money. Every daily commute not by car means approximately one less new car sale every eight years. So a full eighty seat bus or railway carriage every workday morning may well represent ten lost new car sales a year. Significant, when you see a six carriage train every ten minutes, or the line of double decker busses on Fanshaw Street. This impacts not only car manufacturers, car dealerships, and aftermarket retailers but also media advertising, property use, fuel suppliers and road construction. The ownership of these services rationally invest heavily in researching the effects of threats to their businesses and cultivating political and media influence nationally and internationally. to counter those threats. All sound business practice.

By their very nature, conservative, change resistant, political parties are their natural allies. It is just a natural product of our political system. A counter to it is getting high quality information in front of the voting public on the alternatives to a SOV dominated land use and transport system. Something this forum does exceptionally well. Thanks to its dedicated and competant staff, but also general contributors.

+1

Hi Heidi, you (and any other readers) would be welcome to join Fly-Less Kiwis: https://www.facebook.com/groups/352684145282681/ Would be great to have your point of view on this.

Hi Robert, Yes that fb page is a great idea. I have read it sometimes, but am not quite ready to launch into facebook yet…

Put tolls on the motorways, job done. I don’t understand why this wasn’t done instead of the blanket fuel tax. This is common in other countries, it should work here as well.

I’m not sure pushing more traffic onto suburban roads is really the solution to anything.

Yes, and it’s not like this hasn’t been pointed out before.

Ultimately road users will get tired of being stuck in surburban jams and will use the motorways, just like they do in other cities around the world. Aucklanders won’t be any different or do you think we are especially stupid?

A toll ring around the CBD would also include the surburban streets leading into the city, that’s pretty obvious isn’t it?

Some will some wont. I agree that a new equilibrium will be found, but there is no way that if one road is tolled and one isn’t that the volumes will stay the same on both roads as they had been previously.

I can’t think of a city that has tolled it’s entire motorway network well after it was built and left the suburban roads un-tolled, do you have any examples?

Not arguing exactly, but can you think of a city that is so reliant on its motorway network for local and suburban trips as Auckland?

Like we don’t really have arterials, we have local roads leading to motorways.

Oslo, Trondheim, Stavanger all put tolls on there motorways after they were built, all new motorway are tolled and all of the surburban streets leading into and out of the respective CBD’s are rolled.

In a word – yes.

Oslo’s system looks very different to your original suggesting of ‘just putting tolls on the motorways’. They have toll cordons that include all roads within the cordon.

A charge on entering the CBD makes much more sense:

1) The majority of the PT spend will be used by people accessing the CBD

2) It will mainly be paid for by more affluent people who work in the CBD

3) The less cars in the CBD the better

4) It shouldn’t be too political – the majority of Aucklanders don’t work in the CBD

5) Really easy to implement

Not sure why they didn’t just implement this instead of the fuel tax. Apparently they needed 10 years worth of research etc for some reason.

By the way I don’t think it needs to be a congestion charge as such where the main goal is to decrease congestion and the charge is variable depending on the level of congestion. I’m talking about a fixed cost to enter the CBD during the peak period where the purpose is to pay for CBD related transport projects (and decreased demand is just a side effect). It is not intended to be revenue neutral.

Parking levies would be my preference.

Easier to implement?

It wouldn’t stop people driving through the CBD though.

The new zones should stop that.

Surely the problem is much larger than the 40k who drive to the city each day? https://www.stuff.co.nz/environment/climate-news/110114994/this-moment-will-not-come-again–councils-8bn-climate-change-warning

Local Councils say that they will need $5 – $8 billion to replace infrastructure due to climate change. Persuading less people to drive to the cbd is only part of the answer to reducing carbon emissions. If Auckland is to address the problem it will require radical change to the carbon emitting activities in the city. Fossil fuel vehicle use is the first. Currently PT mode share is only 5% Auckland wide (RPTP).

Most likely the answer is parking levies; and road charges; and increased motor licensing fees for larger vehicles (Australia amongst other places); and motorway tolls; and in return cheaper PT so that the less well off can move around the city, and also any others who choose to abandon SOVs as their predominant way to navigate around the city. Climate change also won’t be achieved by only the poor making lifestyle changes.

If the problem is vehicle emissions then the solution is additional fuel tax. The more you burn the more you pay.

Yes, but the Nats don’t want to that either.

I support this idea but this isn’t a direct substitute for a fuel tax. Which option is better depends on what you’re trying to achieve.

A fuel tax is quick and easy to implement as it doesn’t require any new infrastructure. It’s an efficient way of raising revenue but a blunt instrument for reducing driving.

Motorway tolling / road pricing / congestion charging is expensive to implement because it requires lots of new infrastructure. Your idea would require tolling gantries on every on and off ramp, of which there are a lot. The cost of implementation means its a poor way of raising revenue but its targeted nature means it’s a good way of reducing driving.

My understanding is that congestion charging hasn’t been implemented in NZ yet because of both political and technological uncertainty. NZTA aren’t going to be in a hurry to introduce it when they expect that a new government could just come along and scrap it. Likewise there are a myriad of ways you could implement congestion charging (gantries, in-car transmitters, in-car GPS recorders etc) and the technology is evolving fast.

I expect NZTA want to wait until a clear technological winner emerges but at the current pace of change that may never happen. Kind of like postponing buying a new smartphone because a new, faster model is ‘just around the corner.’

“Motorway tolling / road pricing / congestion charging is expensive to implement because it requires lots of new infrastructure. Your idea would require tolling gantries on every on and off ramp”

Why would it need tolling on every on and off ramp? First, there is the evidence of the Northern Gateway toll where very few people dodge the toll by driving through Orewa.

When I travel overseas I see much electronic tolling on motorways and people simply seem to pay the toll.

Surely there would be smart places to place tolling facilities in Auckland? On the Shore before Albany coming south and again on the bridge? Avoiding the tolls would be arduous.

More expensive to collect than the fuel tax? Yes because infrastructure is needed; but other countries have clever systems where tolls are debited against an individual’s pre-paid account thereby transferring collection costs to the user.

The hardest thing about implementing road tolls is the political fallout.

The government should scrap the regional fuel tax and replace it with congestion charging. Regional fuel tax is an old way of doing things – the thinking needs to develop as technology becomes available.

A few things

First there is Option 4. SELL ratepayer assets,otherwise known as Auckland Council assets. This could easily be marketed as a win win, a complete lie of course but spin doctors are good at this.

AC is like central government once was, bristling with assets and back in the halcyon days of Roger Douglas and Ruth Richardson, these were flogged off to the wealthy to make shit loads off much to our detriment (tried getting fibre broadband installed and properly by Chorus, for example? Good luck to you). National want the asset sales option more than anything else as those connected to their way of thinking can line their bank accounts with the booty, to hell with Auckland.

Secondly this government badly needs to get its act together right now to a), to commit AT to have clear milestones of achievements with the fuel tax, reviewed quarterly, to justify it or else, and b) demonstrate to the public what has been achieved as a result of the tax and how, if it were taken away we couldn’t have nice things for the betterment of the city. PERCEPTION followed by RESULTS. You know, sell itself. This thinking is beyond Phil Twyford, a man with good intent but worryingly appearing to have no idea beyond that, who thought it was job done by agreeing to the tax and leaving AT to sort the spending out. Hence things like light rail must get underway in bricks and mortar type of way, way earlier than is usual or else it will be lights out for the idea, let alone any project.

Thirdly, Nationals tax cut equals cuts elsewhere, even if it only amounts to a cheese burger combo each week. And I am so touched Simon Bridges suddenly cares about peoples earnings. Under his last government the low wage economy propped up by unlimited exploitable labour was the model and he didn’t seem so worried back then. Hmmm, could he be lying?

The fuel tax is regressive and hits the poor. I see no reason why these projects aren’t funded from general taxation.

As pensioners we don’t pay much tax but have lots of time to drive around our city. Don’t agree any cluttering of roads we do should be played for by the general taxpayer.

Can we first repeal increases in public transport fares? Perhaps by adjusting the ridiculous government fare box recovery demands? Why do people think that driving a private motor vehicle is a basic human right? We are a privileged citizenship and paying an extra 10c per litre of fuel is your choice…you could just pay an extra 10c per ride on the bus!

I agree with you

Yes, using the AA’s figures of 14000 km/year for an average car, and 1253 litres used for this mileage, for a medium car, the RFT has added $125 per year. That’s a lot of km. Much more than a simple commute for most people. It’s the family’s movements around for many activities.

Now compare the fare increases for a family. If there are 10 c per trip extra for each of 2 adults, 20 c per trip extra for one student and 15 c per trip extra for a child, and they each do, say, 15 trips a week – that’s an extra $400 per year.

Just rough figures, of course. You’d probably have to work out a set of trips that a family would want to do and make a comparison of the increase in costs for each of the modes. But it’s pretty clear the people crying equity about the RFT should be at least as vocal about the fare increases.

Silly National and it’s lower taxes campaign platform. People in countries with higher taxation don’t seem to complain from what I’ve seen.

Perhaps slightly off topic but how about this approach from Strong Towns in the US – you don’t do arterials, you do networks to disperse the traffic through the suburbs but importantly introduce traffic calming so residential streets speeds are 30kph.

https://www.strongtowns.org/journal/2019/1/30/the-neighborhood-traffic-trade-off

A revolutionary concept that I think deserves a separate post by Greater Auckland.

I’ll have a read sometime. At first glance, I’m not sure… What we’ve seen in Auckland is a spreading of traffic from the arterials onto the ratruns, due to congestion. That’s not been a positive change. A fine grained grid network for active modes is really important. In Auckland, with our high car ownership and sprawl, I’d imagine a fine grained grid network of streets for general traffic would simply mean more of the residential roads become unpleasant with lots of traffic. I’d do the opposite. I’ll definitely consider the ideas in the article if I do write something. But don’t hold back from offering your own post, Peter. Thanks.

I would be surprised if National got rid of the fuel tax – what they should do is ensure it is better spent and targeted 100% on solving Aucklands transport issues. That means Phil Goff does not get his legacy rugby stadium or any of the other hair brained ideas the council have.

What they should also do is move to a more fair system of raising council revenue. Instead of taxing peoples assets (the houses Cindy wants to tax), there should be a council tax paid by every household. I know the millennials do not like this concept – but when did the self entitled generation want to pay a fair share of anything? If every household paid a tax (like in most countries), then the council would be able to raise significantly more revenue in a significantly more fair way.

Rumour has it that there is a council tax paid by every household, going by the name of rates.

Rates are paid by house owners. Not by households. Your inevitable and flawed argument that rate are included in the rent is as silly as saying tradies are passing on the regional fuel tax in their hourly rates.

It is crazy that in NZ we collect regional taxes from house and business owners and let renters off scott free.

Everyone should pay a tax, based on how many people are living at each house. Or do you not want a far system Jezza?

Yeah totes silly. It’s like claiming petrol station owners pass on fuel tax to the customer, or that dairy owners aren’t personally paying gst for the people coming in for a little of milk. ♂️

I’d be surprised if tradies aren’t passing on the costs of the regional fuel tax, they are business people after all. As for landlords sure some are making a loss because they bought the house at a grossly inflated price and are hoping for capital gains, that’s their choice, they are certainly entitled to build the cost of rates into the rent of they want.

It’s hard to comment on your proposal as I’m not sure if it is a flat rate or tied to the property value. If it’s a flat rate then I am surprised you are not also complaining that income tax is unfair as different people pay a different amount. If it’s tied to the property value then why would you add an extra layer of paperwork by charging the residents rather than the property owner?

You are choosing to ignore the unfairness of rates. Local Government needs to raise revenue to pay for the services provided to the local community. Local roads, public transport, sports facilities etc etc.

The cost of these services should be born equally across the community as a user pays system. If you are lucky enough to own 4 houses, you are not benefiting four times, so other than to satisfy socialist envy, why are you expected to pay?

It is high time the people that are renting, paid their fair share and if we charged every adult a council tax then the council would raise much more money in a much more fair way.

Funding local Government based on one asset class is bat shit crazy. Obviously this is never going to get the support of the Greens while Chloe still lives with mum and dad, but NF (the real Government) should be pushing for this. Maybe when Shane has stopped moaning about Air NZ, he can address this?

I’m not sure how you can claim a flat rate for everyone is fair, some people will use council services and assets much more frequently than others.

As has already been mentioned the owner of the four properties is perfectly entitled to pass on the cost of rates to the residents. If they can’t cover the costs of a property from the income it brings in it would suggest they have made a very poor investment choice.

With your proposal levy residents rather than property owners how would you cover the costs of services in places with a high proportion of unoccupied dwellings like baches? Are you suggesting that the residents of the Thames Coromandel District pay for all of their infrastructure and services even though bach owners also benefit from these?

David what you call unfairness is intentional, is just, rather than level; is the difference between equity and equality. Flat taxes may seem to be fair, and would be fair in a world where all income and capital were also flat. In the real world, however, flat taxes are highly regressive; punishing those with less savagely.

You are simply advocating for a much less fair society, in the name of fairness.

I wonder how Patrick can claim flat rate taxes are unfair but then not protest the regional fuel tax? If you have a disposable income of $100 a week, the fuel tax is going to hit you a lot harder than if your disposable income is $500.

A council tax would be a levy based on how many adults live in the same property. It would also be banded, so that larger properties pay more than smaller. Like in the UK. That addresses the issue of affordability. Empty houses could attract a fee, solving the problem of investors sitting on empty housing stock and means that the communities of weekend occupancy (baches) also have an income. It seems to work very well in the UK and it is a lot more fair than rates.

Yes fuel taxes, being flat, are more regressive, but transport, being half funded by property tax, which is more progressive, does add balance to that (which makes having that progressive tax even more important).

And of course there are unfairnesses, inequities, in all taxation. Examples can be found for both sources of revenue: the little old lady who doesn’t leave home much but owns a valuable property or two is paying disproportionately for transport through rates, and the poor household living away from PT’s reach with long drives to work are like-wise hit by fuel excise.

There is little purity to this, outside of a rough calculation that the unfairnesses kind of wash.

The bigger problem, in my view, is that as all transport is subsidised, we continue to over-subsidise the form that is economically, environmentally, and socially negative; driving, too much. And the positive ones too little…

David, third party collection of taxes is common. PAYE is collected by employers in behalf of the Government, but in that case it is compulsory they pass it on. Just consider yourself lucky that for rates, you actually have choice as to whether to pass it on, to your dwelling’s occupants or not.

A household tax has a fundamental difficulty that most likely makes it fundementally flawed as household occupancy is so dynamic. Does it just become a bedroom tax, singles or doubles? Does every NZ resident annually nominate their residence for the year, and the council of that nominated residence collect the funds?. Difficult means expensive to collect and enforce. Any benefits are outweighed by the costs of it’s complexity.

Hot off the press – the Tax Working Group supports congestion charging.

From https://taxworkinggroup.govt.nz/sites/default/files/2019-02/twg-final-report-voli-feb19.pdf, p50:

Road transport

Evaluation against the framework

105. Road transport generates a number of different negative externalities. These include road damage, congestion, greenhouse gas emissions, air pollution, noise, surface pollution, injuries and death. Some of these externalities better meet the criteria for negative externality taxes than others but there is generally a good fit.

106. A number of tax instruments already address some road transport externalities. For example, the ETS prices greenhouse gas emissions, and petrol and registration levies fund costs relating to injuries and death.

Measurement and pricing

107. Congestion is likely to be the largest unpriced externality in road transport. Local air pollution, surface pollution and noise are also unpriced. These externalities are highly specific to time, place and type of vehicle. This has historically created measurement and pricing challenges.

108. There are now a range of technical solutions to make measuring and charging for these externalities feasible. For example, an enhanced road user charging system that captures information on location, time, type of vehicle and load could allow for more refined pricing of a broad range of externalities.

Equity

109. Several submitters raised equity concerns with transport pricing, especially the impact of fuel taxes on low-income households. It is difficult to generalise about the impact of transport taxes. It will be important to assess the distributional impacts of specific proposals, and equity constraints could mean that pricing is used to signal some types of externalities, rather than accurately price them.

Assessment

110. The Government and Auckland Council are currently considering whether or not to introduce congestion pricing in Auckland. The Government’s Urban Growth Agenda is also scoped to review the future of the transport revenue system. The Group supports these reviews as an opportunity to better align road transport charges with externalities.